So what’s going on with the dollar? Wasn’t it collapsing under the weight of inflation and recession, soon to be replaced by the RR (Renminbi-Ruble) currency system?

Despite many arguments for a weaker USD, the dollar index $DXY actually gained 10% over the last year.

How so?

I asked this question on Twitter and want to thank everyone for their replies. As many pointed out – there are a few reasons why $DXY has been gaining ground. Let’s discuss them here.

Teaching FX Markets this week. A question to the class:

• 8% inflation erodes dollar's purchasing power and real returns.

• Yield curves inverted – potential recession, bad for FDI and foreign capital flows.

• US assets are selling off.Why is dollar stronger and $DXY up?

— Sergei Perfiliev 🇺🇦 (@perfiliev) April 11, 2022

1) Very Hawkish Fed and QT:

Fed is about to embark on a sharp and aggressive tightening cycle with rate hikes, QT, blackjack and hookers. Higher rates attract capital flows as investors can park their cash at more juicy yields in the US than could otherwise be available locally.

Higher rates also mean that money is more likely to be sitting around in banks rather than circulating care-free around the economy. This is further exacerbated by Quantitative Tightening (QT).

Some commentators pointed out that QT is like a share buy-back for dollar. Indeed, last week the Fed announced they will sell over $1T worth of balance sheet inventory per year. This is equivalent to purchasing dollars from the system. The proceeds will then disappear back into thin air (Fed reserves) where they originally came from.

2) Difference in Central Bank Monetary Policies:

However, when discussing exchange rates, it’s not enough to simply look at the US and decide on the strength of the dollar. We need to look at what’s happening across the oceans.

For example, the Bank of Japan and ECB do not particularly share Fed’s newfound obsession with rate hikes. Amid a 1.3% CPI, BoJ can comfortably keep calm and carry on purchasing JGBs because, well, why not, right?

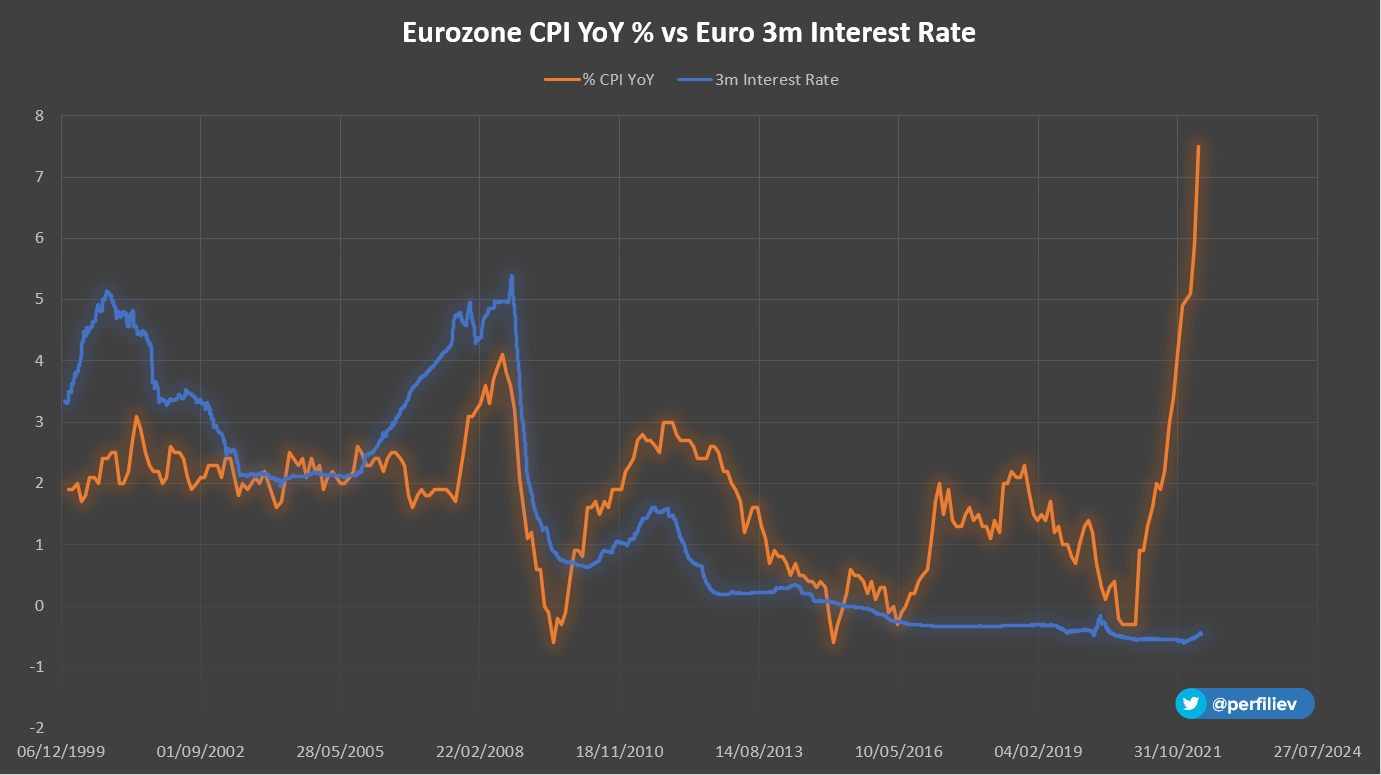

However, it’s kinda getting awkward for ECB now. Eurozone inflation hit 7.5%, but ECB isn’t ready to tighten and keeps its benchmark at an attractive minus 0.5%. They probably have their reasons… (*ahem*, Putin)

So the Fed is finally forced to face the music, the ECB pretends it doesn’t hear it, and BoJ is still struggling to make a sound. With looser (looser?) monetary policy, JPY and EUR have depreciated vs the dollar, and that’s over 70% of $DXY already.

3) Real Rates Between Countries:

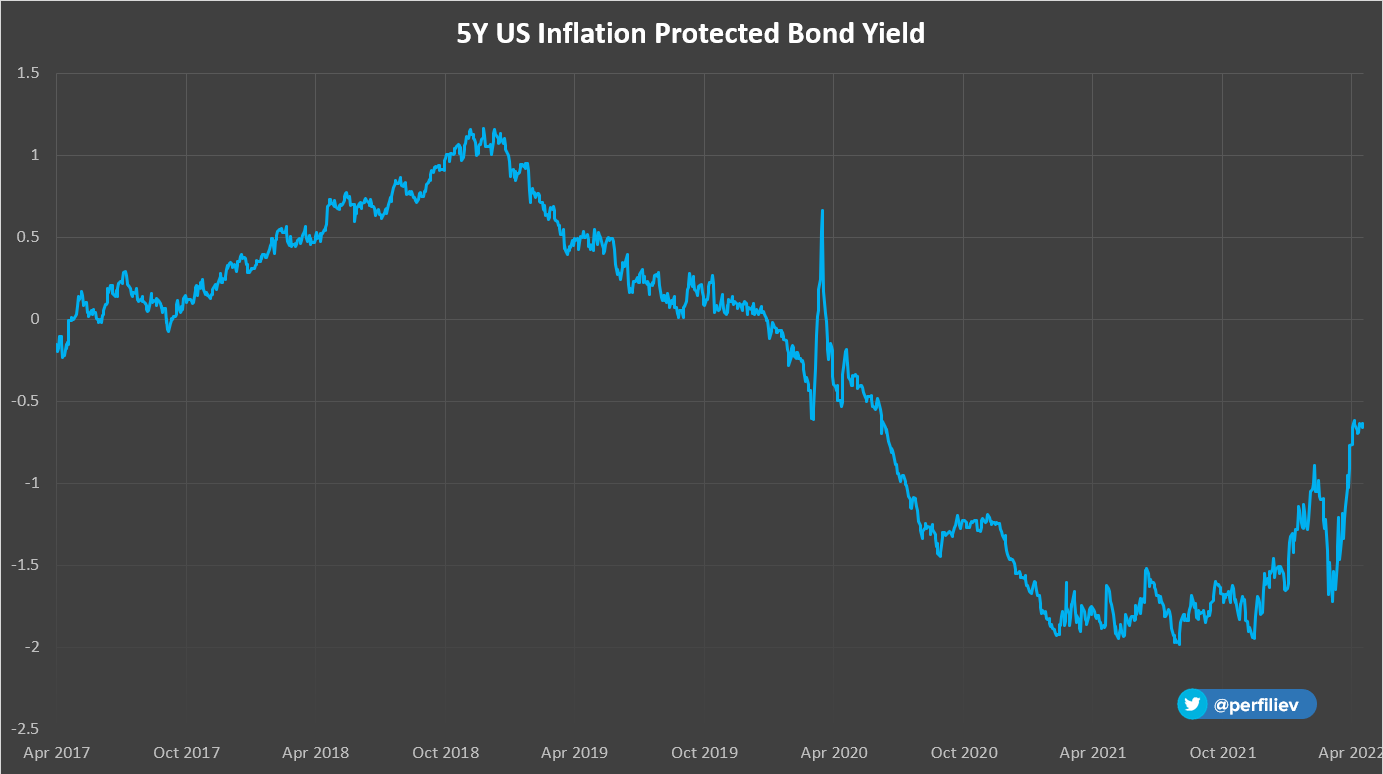

Despite a surge in nominal yields, the US real rates are still negative, which isn’t particularly great. Who would want a guaranteed loss?

However.

Not only they’re rising, but they are substantially “less negative” than in some other places.

For example – you got Euros? Well, do I have a deal for you! You can park them in this premium, inflation-protected 5-year German bond at a whooping -3% per year! Unused, mint condition. German quality. Hey, wait, where you going?

Indeed, the US 5-year real-yield of around -0.6% doesn’t sound too bad now… And it might even get better as the Fed tightens and inflation subsides. The UK 5-year real yield, as proxy-measured by an inflation-protected bond, is at -3.1%.

USD is the least bad choice.

4) Safe-Haven Status:

Dollar is also seen as a safe haven and usually strengthens in times of economic stress and uncertainty. And there’s plenty of that bear porn to go around: yield curves inverting, rates rising, potential recessions looming, war escalating etc.

5) Inflation Expectations:

Yes, the dollar already lost 8% of its value due to inflation, but inflation expectations are actually much lower going forward. Both forecasts and implied inflation metrics show that markets expect inflation to normalize over the next few years.

6) Liquidity and Global Dollar Demand:

Despite any potential weakness, the dollar is deep inside the global financial system. It’s still the world trade currency and global reserve currency. It’s still the most used non-domestic currency for foreign sovereign debt. Many counties peg their currencies against the dollar. Dollars are still needed for global corporations to do day-to-day business.

So yes.

It might not be the perfect guy to date at the moment, but given the circumstances and other options available, it’ll do.

As always, thank you for reading! For more posts, you can also follow me on Twitter.

Let’s keep in touch! 🙂

We're got a lot more exciting stuff coming up and we'd love to tell you about it.