Next week marks the so-called triple-witching when SPX, SPY and ES options all expire. Around $2.5T of options are set to expire next Friday, and like other December expirations, it will be the largest this year. So what does it mean for the markets and the Santa rally?🎄

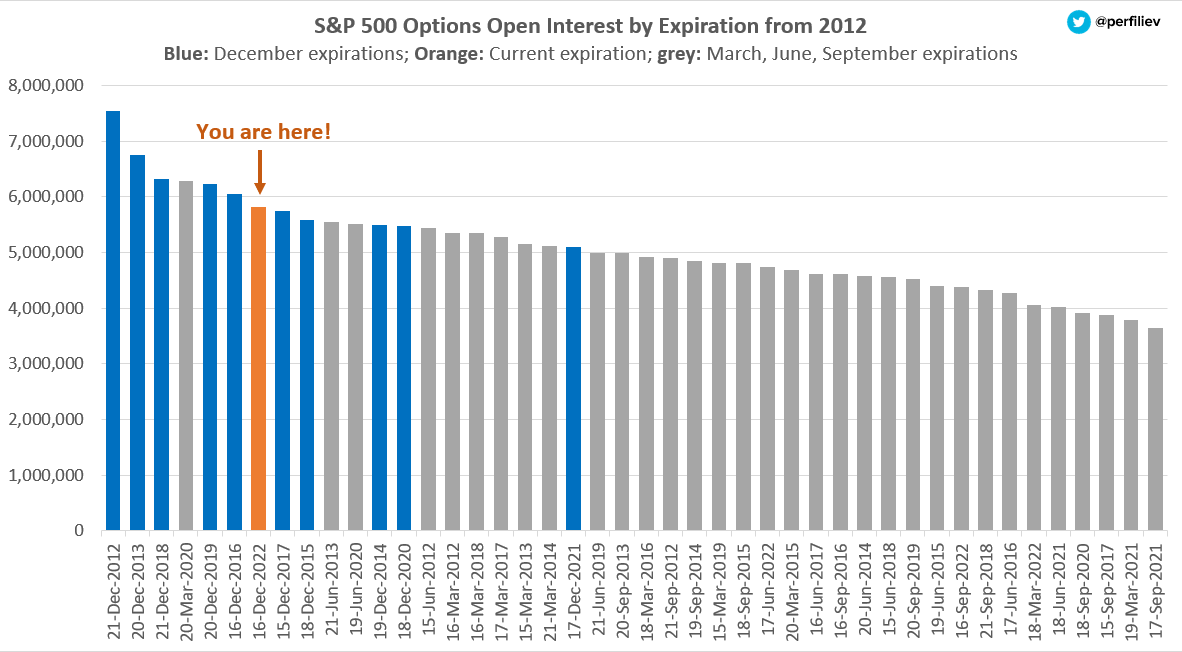

This expiration is large, however, for a December it’s going to be fairly average, with 5.8 million SPX contracts expiring on the 16th. The largest expiration over the last 10 years was December 2012 with 7.5 million contracts.

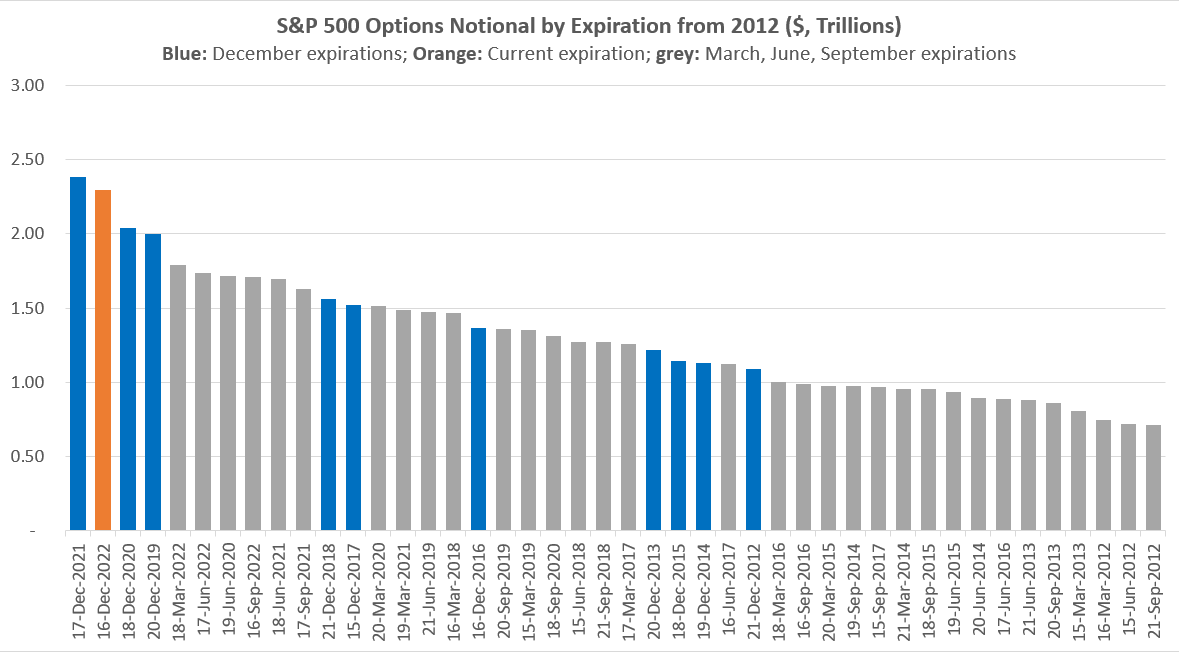

In terms of notional, this expiry represents around $2.3T of SPX index options (+230bn of SPY). This would make it the second largest expiration after Dec-2021, when $2.4T options expired. Yet, notional amounts are a function of index levels and aren’t really comparable.

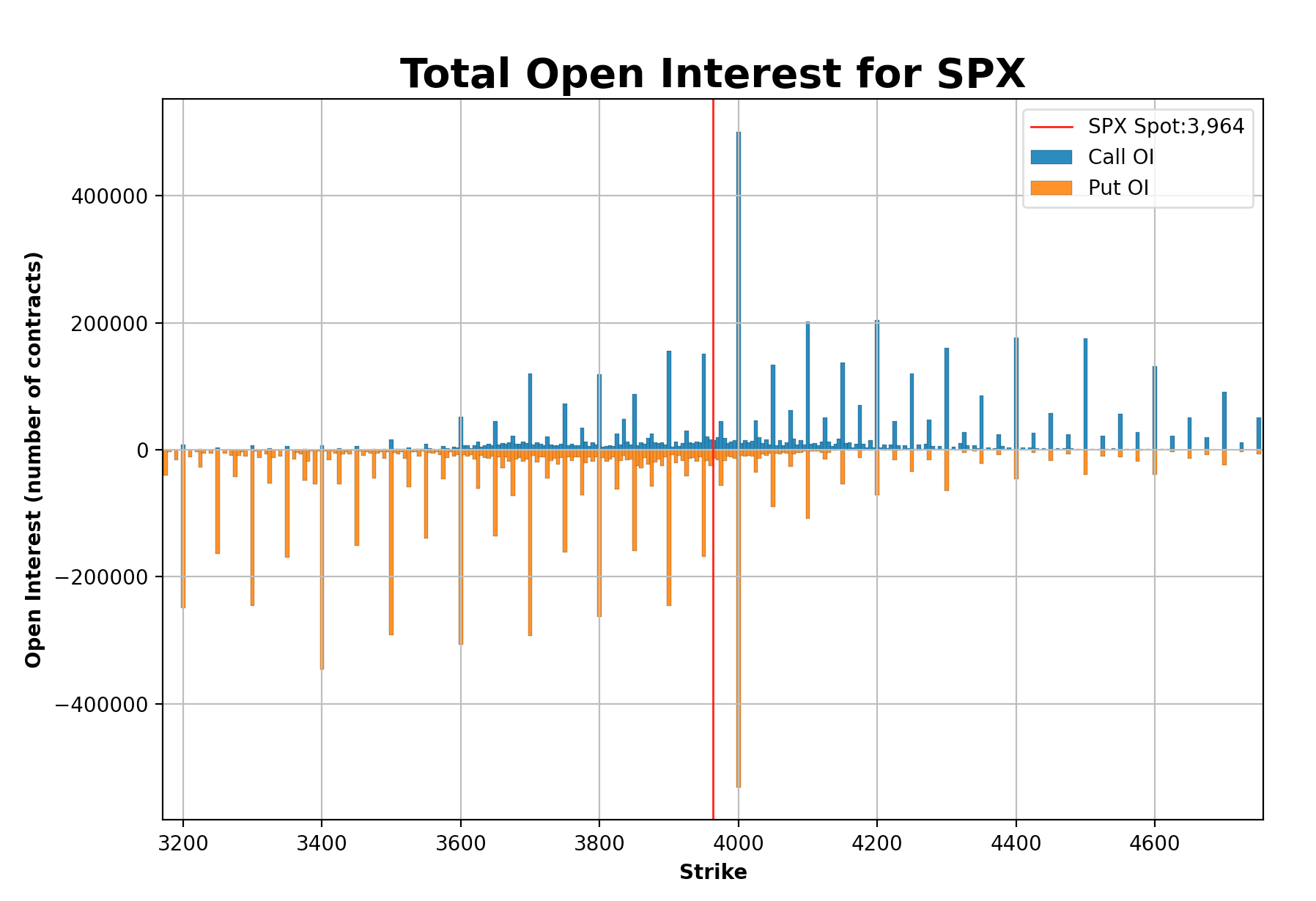

SPX is down 16% YTD so far but is flat since May (!), which resulted in a nice and balanced distribution of OI around the current level.

A substantial chunk of OI sits at 4,000 – this level acted as a magnet and we revisited it many times this year.

Given current positioning, there doesn’t seem to be a clear directional bias, which makes it difficult to speculate as to the direction of flows going into OpEx. Vanna and charm should be supportive, however, their powers are offset by 0DTE call buying and a lack of hedging.

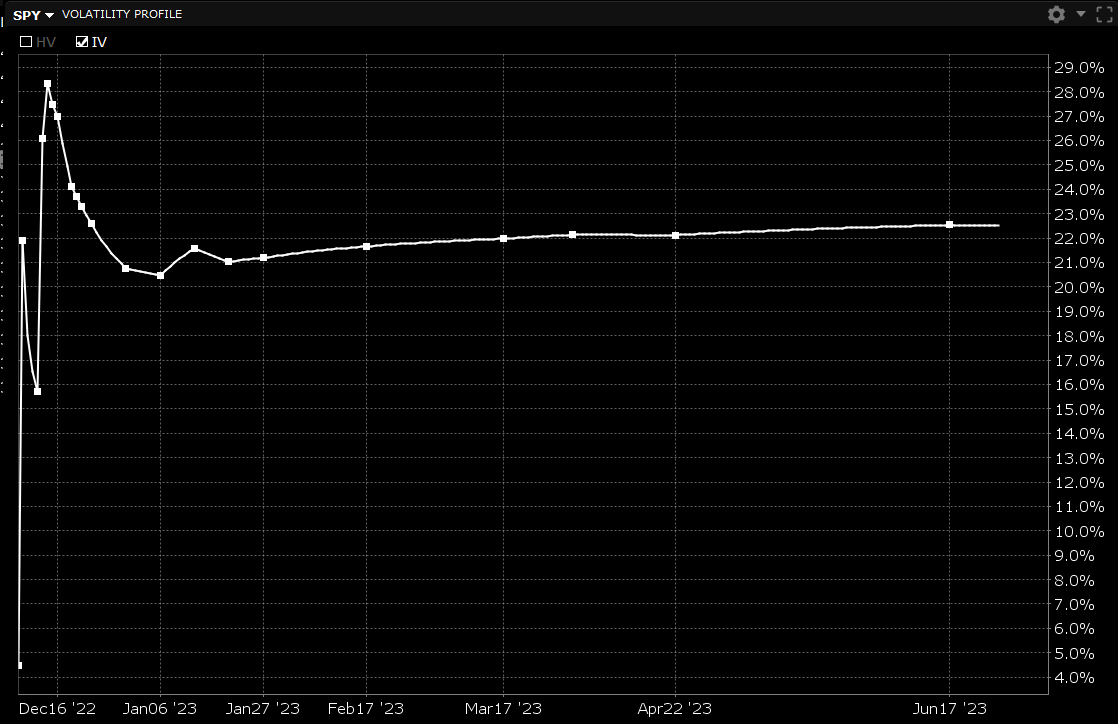

Next week also marks the Fed meeting and a CPI report, which are usually followed by a vol crush. As VIX is floored at 20 and doesn’t want to go any lower, this event vol should provide additional potential energy for vanna flows and might support the SPX when vol unwinds.

Following OpEx, the SPX will be more susceptible to other market forces amid weaker options hedging flows.

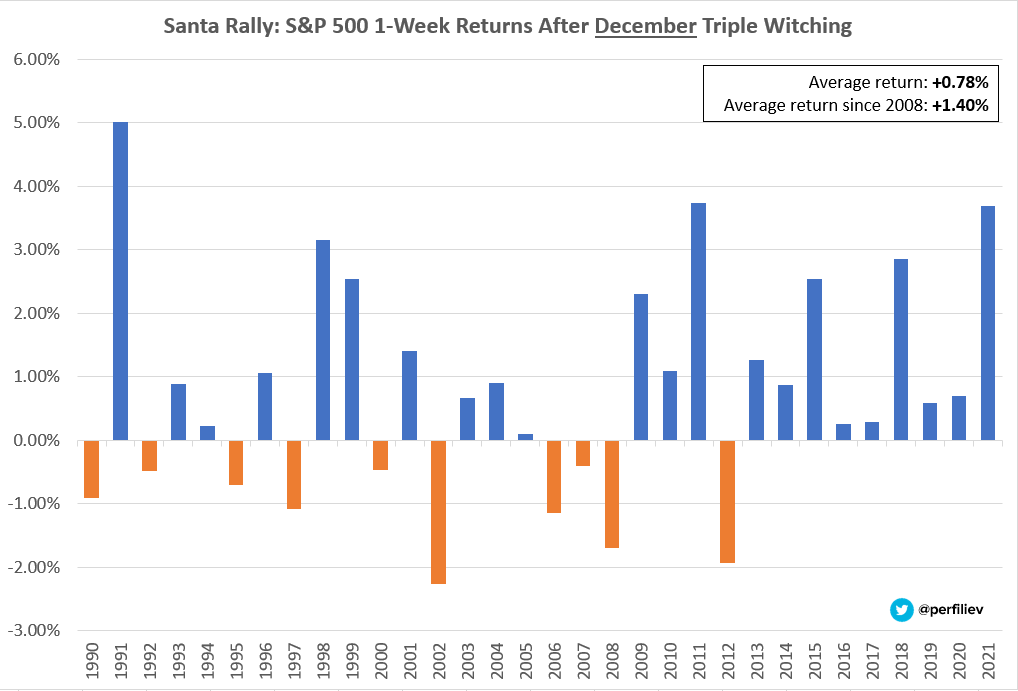

Since 1990, an average SPX 1-week return after December expiry was +0.78%. Starting 2009, an average return was +1.40% and positive every single year except 2012!

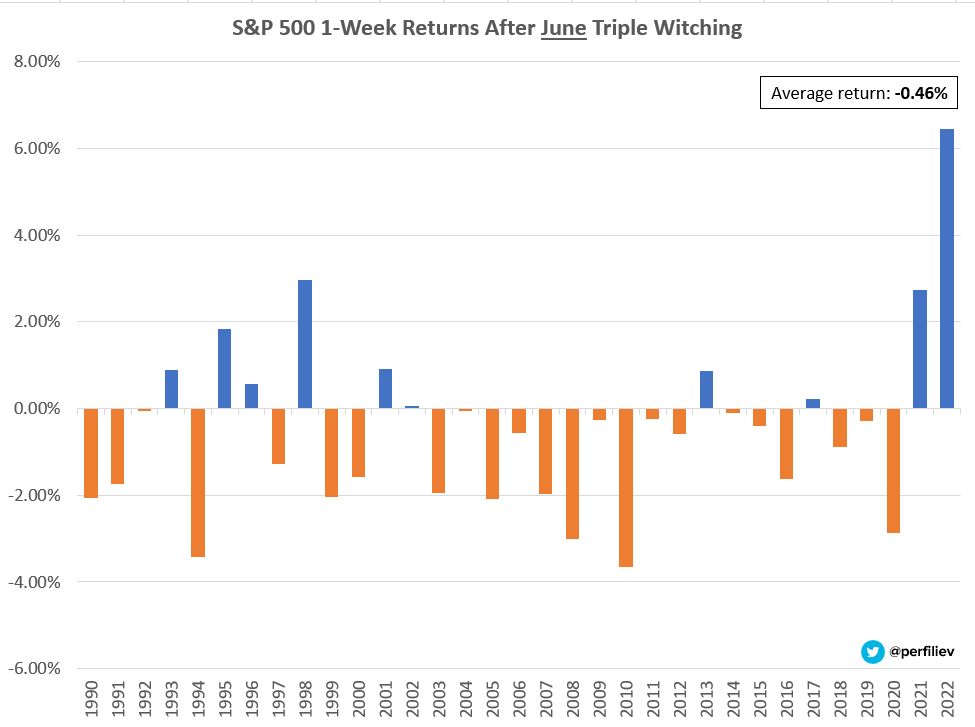

And this is specific to December, as the triple-witching in June shows the inverse! Since 1990, 1-week return following a June OpEx is -0.46% and has been negative 16 out of the last 20 years.

But let’s not rush calling for a Santa rally just yet 🎅 All those positive December returns since 2009 occurred during ZIRP and a highly accommodative Fed.

This is not the case now.

If we look at 2008 and earlier, Santa rally occurred only ~50% of the time with an average return of 0.36%. While the Fed is expected to slow the pace of rate hikes, we are entering 2023 with 4.25%-4.50% Fed Funds that are yet to impact the economy.

Might be different this time…

As always, thank you for reading! For more posts, you can also follow me on Twitter.

Let’s keep in touch! 🙂

We're got a lot more exciting stuff coming up and we'd love to tell you about it.